AEPS Adhaar Enable Payment System

AEPS Adhaar Enable Payment System

Aadhaar Enabled Payment System called AEPS is an electronic payment gateway which enables online payment of money using Aadhar data. The Aadhar Enabled Payment process is an initiative from the government that was established by NCPI enabling customers to access their Aadhaar enabled bank account using the Aadhar details. It was started with the view of speeding the inclusion in the country. People do not need to mention their bank account information to execute these transactions. With the help of this payment system, people can send funds from 1 bank account to another simply via their Aadhaar numbers. As the system functions on a dedicated host, people can send money from their accounts to any account no matter the bank in which the receiver's accounts is operated.

Cash Withdrawal

Using AEPS support, all your business partners can start money withdrawal facility on own retail store to their walk-in customers. Without visiting the bank any customer can withdraw money from his/her bank account. Just visit any of the Retail stores and withdraw the required amount of money by simply providing your Aadhaar number, bank account, and thumb/finger impression. In AEPS you have to use Aadhaar card to scam cash while in mPOS system you can withdraw cash using credit or debit card. We also provide one mpos machine incorporated with mPOS computer software.

Cash Deposit

In the retail store, a customer can use AEPS for depositing money and need Aadhaar number, bank account, and thumb/finger impression. It's easy to get at any time. At the retail store, walk-in customer can check his/her bank accounts balance. For banking, the trade needs customers Aadhaar particulars, bank name and fingerprint, after that his/her can check bank balance detail about the monitor.

Fund Transfer

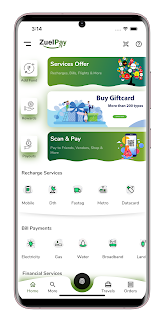

Using AEPS service customer can send money instantly to any bank account through Aadhaar Verification, Aadhar has to be connected with a bank account to use AEPS service. In AEPS service, the fingerprint is authenticated from the UIDAI. In response to trade, UIDAI tells to the lender about the credibility of the user. For much more detail about AEPS service, please send your query here it's possible for you to offer a number of providers using Zuelpay portal. Along with AEPS, you can also offer bill payment services to your customers by integrating Bharat invoice payment system on your portal.

Objectives

- To empower a bank customer to use Aadhaar as his/her identity to access his/ her respective Aadhaar enabled bank account and perform basic banking transactions like cash deposit, cash withdrawal, Intrabank or interbank fund transfer, balance enquiry and obtain a mini statement through a Business Correspondent

- To sub-serve the goal of Government of India (GoI) and Reserve Bank of India (RBI) in furthering Financial Inclusion.

- To sub-serve the goal of RBI in electronification of retail payments.

- To enable banks to route the Aadhaar initiated interbank transactions through a central switching and clearing agency.

- To facilitate disbursements of Government entitlements like NREGA, Social Security pension, Handicapped Old Age Pension etc. of any Central or State Government bodies, using Aadhaar and authentication thereof as supported by UIDAI.

- To facilitate inter-operability across banks in a safe and secured manner.

- To build the foundation for a full range of Aadhaar enabled Banking services.

Banking Services Offered by AePS

- Cash Deposit

- Cash Withdrawal

- Balance Enquiry

- Mini Statement

- Aadhaar to Aadhaar Fund Transfer

- Authentication

- BHIM Aadhaar Pay

Other Services offered by AePS:

- eKYC

- Best Finger detection

- Demo Auth

- Tokenization

- Aadhaar Seeding Status

Comments

Post a Comment