Bank Account Name Verification API

Bank Account Name Verification API

Bank account numbers are quite long and difficult to remember so it’s essential for every individual to verify the account holder’s details before processing transactions. For this bank account number verification API in India is used.

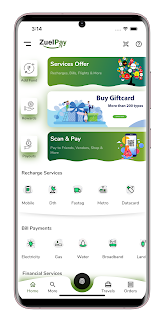

Zuelpay is the most trusted and reliable API service provider company in India providing bank account ownership verification API in India at economical rates. Our bank account name verification API allows a business correspondent to verify the bank account holder’s information for their customers.

Benefits Our Bank Account Name Verification API

- 24X7 real-time expert support to ensure client’s satisfaction and happiness.

- Well-documented and easy to understand APIs.

- Easy to integrate API with 24X7 manual integration support ensuring seamless integration process.

- Comprehensive and comprehensible API documentation with constant updates to provide minutest details.

- Highly secured with the one-time-use passwords generated randomly for each login.

- Error-free and easy to use with an open-source library.

How It Works?

Our bank account verification API offers instant information about the name entered for the online transfer matches the name at the bank of the beneficiary. It helps to prevent money loss due to fake invoices.

Being the top bank account number verification API provider in India, we ensure that your money goes to the right person’s account. Our team of experienced developers works closely with the APIs to ensure the amazing user experience.

Our APIs are the combination of the cutting-edge data science techniques and profound payment knowledge to protect from all kinds of frauds. Now, easily integrate our API on your existing online banking platform and serve your customers with ease.

Why Choose Us?

We also provide portals and white labels to our clients for offering bank account verification services to their customers with their name and logo. Our team of API developers is certified and experienced which ensures the best development process with expertise.

Looking to set up a new startup or want to expand your existing business? Searching for the best bank account name verification API provider? Reach Zuelpay! A trusted and reliable API provider in India providing API services with great expertise. Contact us now!

IFSC Finder API

Banks can help you with IFSC Code API's IFSC Code method. Bank IFSC Code is a service that allows users to obtain IFSC codes and details at any Indian bank branch. The database consists of many banks and lakhs of branches. The Bank IFSC Code API enables developers to access IFSC codes, mic codes, branch codes and other details databases.

Unfortunately, the programmable Web no longer records this API. Usually, this happens when the API provider informs us that the API has been shut down. The good news is that we remember which category it was! Browse to one of the related categories or try to search for new APIs.

What is IFSC Code?

The Indian Financial System Code (IFSC Code) is an alphanumeric code that uniquely identifies a bank-branch participating in two main electronic funds settlement systems in India: Real-Time Gross Settlement (RTGS) and National Electronic Fund Transfer (NEFT) System. It is an 11 character code with the first four alphabetic characters representing the bank's name, and the last six characters (usually numeric, but can represent a branch). The fifth character is 0 (zero) and reserved for future use IFSC code is used by NEFT, RTGS and IMPS systems to send messages to the destination banks/branches.

IMPS (Instant Payment Service)

IMPS (Instant Payment Service) from any IFSC code bank helps you to access your bank account and transfer money quickly and safely. Money can be sent using net banking on an Internet-powered laptop or PC. When a fund transfer is requested on your behalf, the beneficiary account is immediately credited. IMPS service is available 24x7 throughout the year including Sundays and bank holidays. The IMPS service can be used to transfer funds anytime, anywhere.

What NEFT?

National Electronic Funds Transfer (NEFT) is a nationwide payment system that facilitates one-to-one fund transfer. Under this scheme, individuals can transfer funds from any bank branch to any person with any other bank branch in the country participating in the scheme.

What is RTGS (Real Time Gross Settlement)?

The acronym 'RTGS' stands for Real-Time Gross Settlement, which can be defined as the continuous (real-time) settlement of funds individually based on the order basis (without netting). Processing 'real-time' means the processing of instructions rather than the time when they are received at some later time. 'Gross settlement' means that money transfer instructions are disposed of individually (an instruction based on the instruction On). Considering that money is settled in the books of the Reserve Bank of India, payments are final and irrevocable.

Comments

Post a Comment